Capabilities

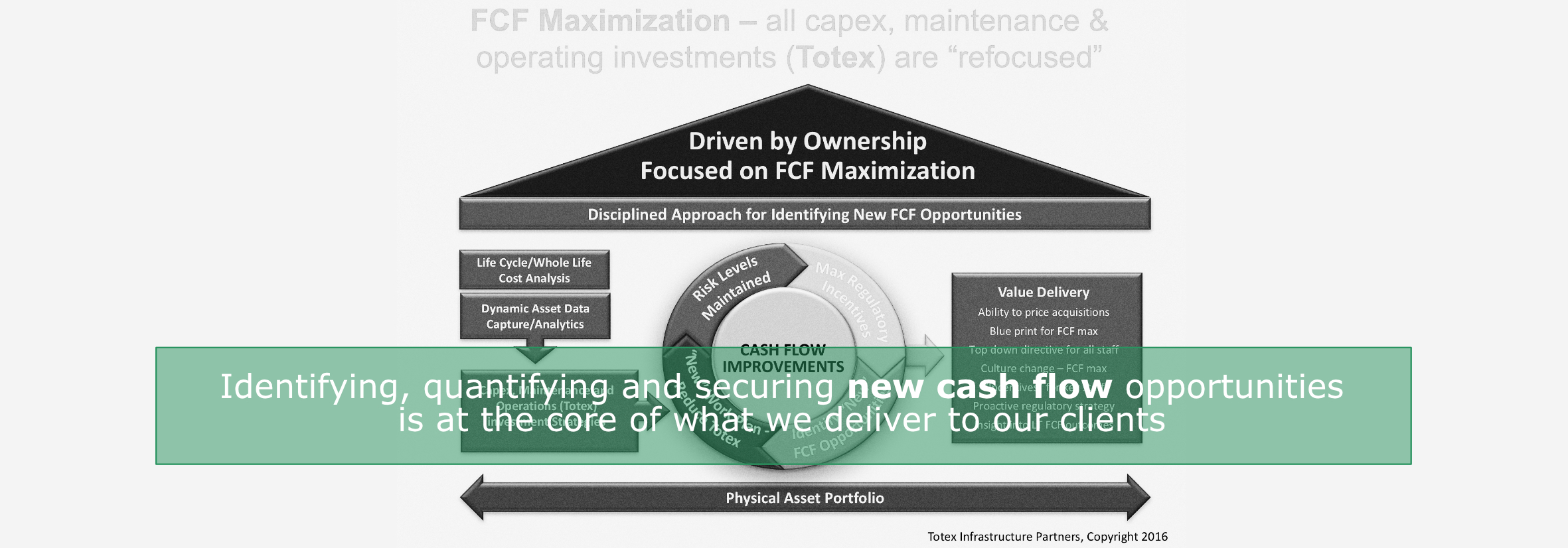

Acquisition Advisory: analysis and modelling of status quo construction, whole life cost strategies, capital and maintenance, regulatory and risk, shareholder dividend, risk management and long-term planning strategies; recommendation of “new” approaches that optimize asset data capture, construction and engineering evolutions, regulatory schemes and whole life cost minimization strategies to maximize cash flow outcomes; identifying and securing “hidden” value.

Asset Level Project Advisory: whole life cost minimization plan development; construction and engineering review; strategic alliances and partnerships; risk mitigation strategies; regulatory business plan development and support through acceptance; financial optimization strategies; ISO 55000 and PAS 55 strategies and support; ongoing optimization modelling; new contracting approaches.

Owner Representation: project execution; construction and engineering oversight; construction material assessment and recommendation; contracting strategies; risk mitigation approaches; ongoing efficiency modelling; asset management program development and management support; utility-level C-level HR strategies and prioritization; strategic alliance partner recommendations and support; board-level performance reports and recommendations; M&A strategies.

Capital Advisory: capital and maintenance planning; ROE and “incentive” strategies; shareholder dividend maximization planning; cash flow maximization strategies; new construction optimization planning; life cycle/whole life cost minimization strategies and modelling.

Management has provided strategic advisory work for the following clients and corporations:

- Thames Water – Implementation of asset level decision making framework, methodology and software to support the investment of $ XXX in the management of their 150,000 km of underground assets

- UK Gas Distribution – Asset level risk based advise for regulatory permit compliance around the UK’s $11 billion gas distribution RIIO-GD1 program

- South West Water – New capability and software to ensure optimal investment plans across 674 water and waste water treatment works and 1,111 pumping stations

- UK Water Sector Industry Research – Totex risk based asset investment decision making framework to be used a basis for all of the individual company investment programmes

- Anglian Water – Development of asset management and decision making capabilities to deliver financial returns and performance commitments at a managed level of risk

- Scottish Power Generation – Risk based decision framework and capability to improve capital allocation across the portfolio of generation assets

- UK Water Companies – Stakeholder consultation and customer engagement in Totex based investment planning and decision making including the incorporation of Willingness to Pay

- Welsh Water – Implementation of whole life asset level analysis and planning capability and software for their underground assets, treatment works and pumping stations that delivers optimal Totex plans based on managed risk, performance commitments, customer and stakeholder requirements and desired financial returns

- Oversaw the building of a $900 million (revenue) Energy & Mining platform at Aegion, including the maintenance of upstream and downstream energy assets, through strategic acquisitions and organic growth

- Over 5 years, provided strategic direction on Acquisitions, board (strategic and Capital advisory) and management oversight (Owner Representation) to grow Aegion from a $500 million single industry entity to become the global, diversified pipe renewal/management leader with over $1.3 billion of revenue

- Provided strategic advisory on Acquisitions, board (strategic and Capital advisory) and management oversight (Owner Representation) to Lafarge North America for over 30 years, which helped enable it to achieve the market leadership position and attain over $6.3 billion of revenue at the time of its sale

- Government of Canada: provided strategic advisory for the Government of Canada’s Department of Finance and its budgeting strategies for addressingthe $17 billion highway funding gap as Chair for the Coalition to Rebuild Canada’s Infrastructure

- Southern California Edison: Asset Level and Capital strategic advisory for their construction and Water Energy Nexus initiatives

- City of Chicago: Provided Asset Level and Capital strategic advisory to the Water Department Commissioner for its $500 million + wastewater network renewal program which generated over $210 million of NPV efficiencies

- LafargeHolcim: strategic advisory and partnership strategies for its proprietary Ultra High Performance Concrete solution for renewing civil infrastructure, which led to a new, proprietary and branded concrete

- Aliaxis Group: Life Cycle Cost strategic advisory, new product development and partnership strategies for new infrastructure opportunities that led to a major new construction product initiative

- Citipark: strategic advisory on all M&A activities for Canada’s largest parking management company (at the time) and oversaw all strategic initiatives (Owner Representation) in Eastern Canada